Credit Solutions

Military Lending Act (MLA)

Are you compliant with the Military Lending Act (MLA)? ProMax has a solution!

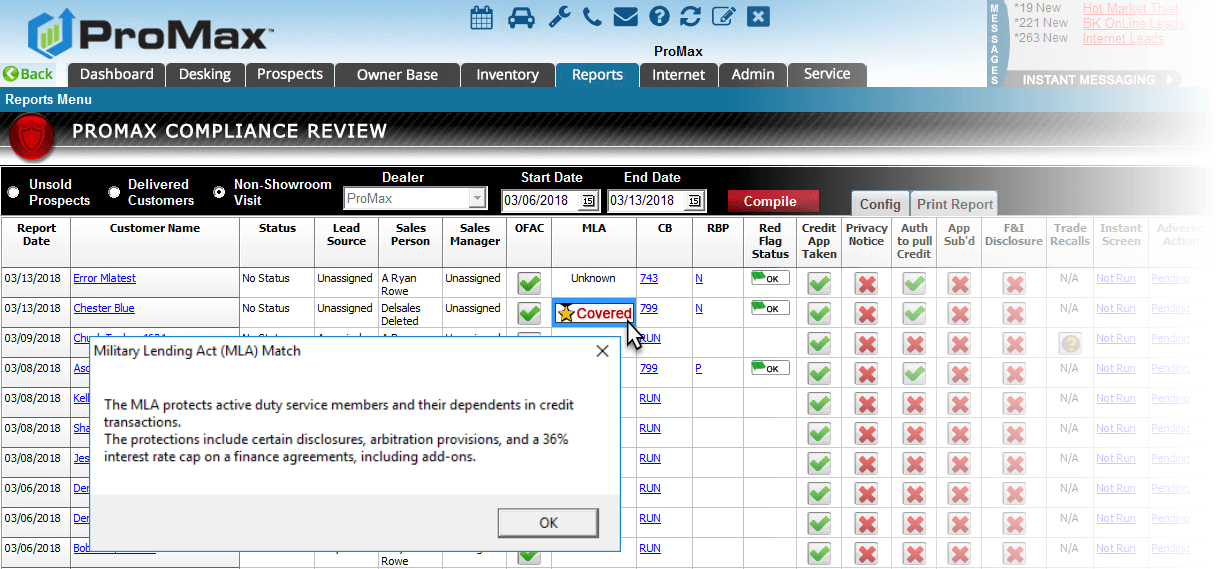

The MLA Final Rule states it is the financial institution's responsibility to confirm an applicant's MLA Covered Borrower Status in accordance with the changes made to the Military Lending Act of 2016. ProMax's solution automatically checks your buyer's MLA Covered Borrower's Status from the Department of Defense's database whenever a Credit Bureau is pulled.

If your customer is covered, you'll see it noted throughout ProMax: in the CRM, in Desking, and on the Credit Bureau itself. If you desk a deal that's out of compliance, you'll get a popup telling you so.

- Help ensure safe harbor compliance with the expanded MLA requirements effective October 3, 2016

- Save time and resources with an automatic status check in ProMax prior to origination or closing

- Maintain safe harbor and help avoid penalties or uncollectable loans associated with MLA non-compliance

Don't get caught out of compliance with this rule! Ensure safe harbor and avoid penalties with our foolproof MLA solution.

For more information about MLA or to get signed up, fill out the form below or contact us at 800-322-9034.